The Boeing Services Market Outlook (SMO) covers the support and services functions commonly found in the aviation market today. The SMO is a 10-year forecast, serving to guide business planning as well as to share with the public our view of industry trends in the commercial, business aviation, general aviation, civil helicopter, and government markets. Boeing models for projecting the size of services markets are analytically linked to the proprietary models we use in forecasting world airline fleet and government budgets. They also are linked to independent assessments of the forces driving specific markets.

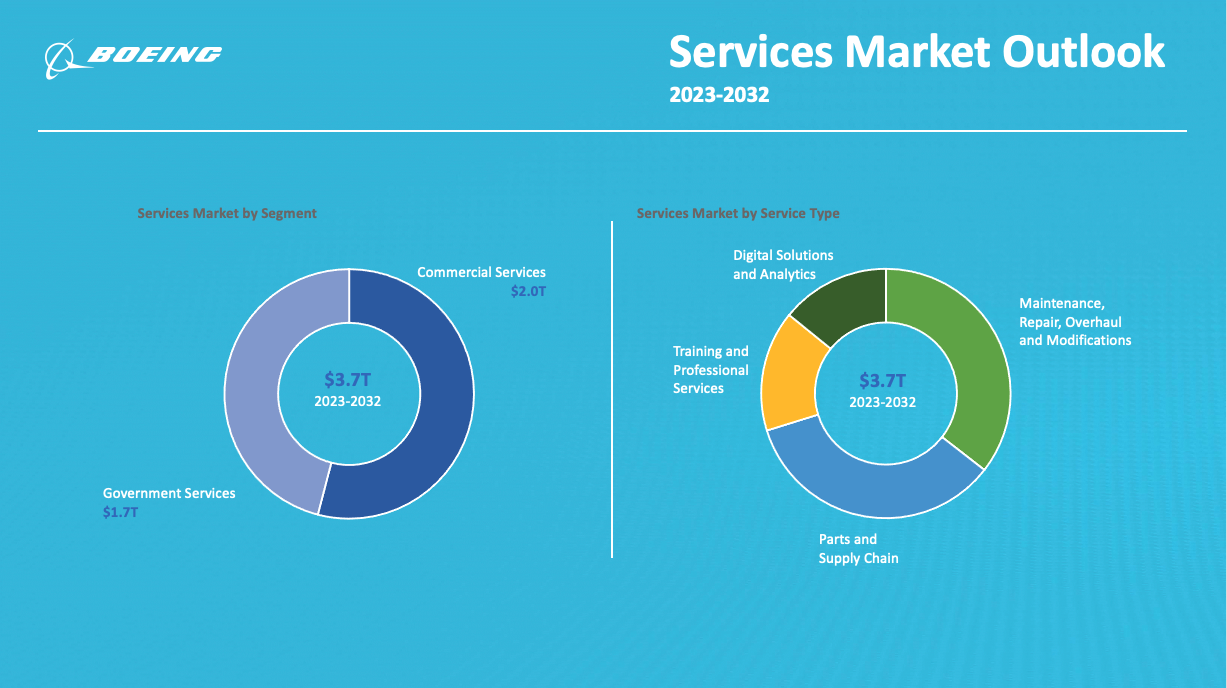

Overall, Boeing expects the market for support and services to be worth $3.7 trillion in the 10-year period between 2023 and 2032. Commercial services, including support for the business and general aviation markets, represent $2 trillion of the forecast. Government services are forecast to be worth $1.7 trillion. Support and services functions are diverse in terms of sales, activity scope, capital intensity, and competitive environments. We segment these service functions as: maintenance, repair, overhaul, and modifications; parts and supply chain; training and professional services; and digital solutions and analytics.